While not a perfect report, with revenue down 4%, Better Collective co-CEO Jesper Søgaard is pleased with the performance. Underlying growth, including gains on revenue share deals in North America, is visible. Customer-friendly sports betting results and Brazilian and FX impacts were drags, but the Dane is confident looking ahead.

The rollout of the AI-powered Playbook tool, which allows X users to be driven directly to sportsbook partners in the US, has been championed. The uptake in prediction markets is also viewed as a potential boon.

And with the World Cup next summer, plus a leaner organisation, Søgaard insists the affiliate is in a good place as it prepares to exit 2025.

EGR: What’s your reaction to the quarter, given a hit from sports results and Brazil but some underlying growth in the business?

Jesper Søgaard (JS): Adjusting for the customer-friendly results, we were very pleased with seeing adjusted organic revenue growth. When we look at North America, and specifically look at the revenue share development, it’s also very encouraging to see high growth, doubling revenue share compared to last year for that part of our business. We’ve been speaking about that a lot over the years and now you start to see that revenue being recognised in the North American business.

I would highlight our launch of Playbook, which has gone very well. We’ve already sent millions of bets to our partners, facilitating that infrastructure and utility. We see great adoption with the users for Playbook. It’s our first real consumer-facing product, where AI is a critical part of allowing for that experience.

EGR: When are you expecting to see a full turnaround in Brazil, seeing as the region had a €4m revenue hit attached to it?

JS: We know that for 2025 when you compare it to 2024, we have that disadvantage because we simply got into a new regime on 1 January with the regulated market. We guided for that in the beginning of the year. I think the good news is that it has not impacted us as much as we feared.

We’re pleased with that development, and then it’s incremental growth from here, while still having the challenge of the ban on sign-up bonuses in Brazil. I think I speak on behalf of the entire sector when I say that you will see significant leakage to the unlicensed market because of it.

We’ll grow our business, but we do hope that eventually there could be changes to the regulatory regime in Brazil.

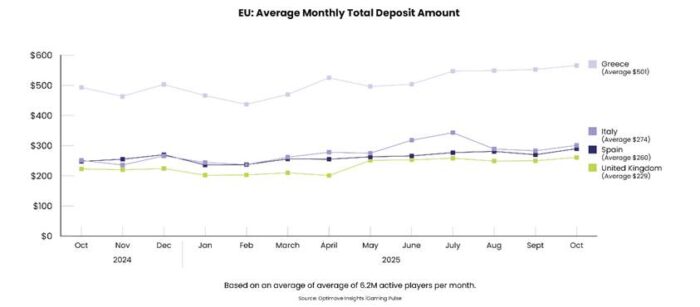

EGR: New depositing customers were down from 396,000 to 279,000, but the value of deposits was up 2%. Is this a new trend we can expect to see and is it what operators want?

JS: We have a great alignment with our partners. It’s a game of delivering value, and we take part in that value. We are really aligned there with our sportsbook partners. And obviously, when I look to 2026 and the World Cup, I definitely expect we’ll see a lot of activity on customer delivery.

Looking at this quarter, in adjusting for [Euro 2024] and Brazil being historically significant, things are fairly normal. But obviously we want to see an even stronger development next year, and I think it will go well with the World Cup.

EGR: FanDuel has joined DraftKings in announcing sports event contracts in the US. As an affiliate, what is your take on the decisions?

JS: For us, it’s really a win-win. We have new customers coming in that we cater to, and we have the relevant audience for them we can deliver in states that have not seen sports betting regulation.

When you look at our audience at Action, Vegas Insider, Yardbarker, all our big brands in the US, our audience is the prime audience for both sports betting and the prediction markets. We are super relevant in that regard.

My expectation is that this will also be a driver of further sports betting regulation and igaming regulation. On all fronts, we’re very pleased with this development.

EGR: Can you touch on the impact of generative AI for the business and wider affiliate sector?

JS: We have a broad and diversified business. We are embracing the opportunities of AI. We are also seeing increases in audience coming from chatbots to our brands. Fundamentally, in our business, we care about brands. We are so focused on owning strong, authentic and authoritative brands that are relevant within each topic.

What matters in both an agentic world and in the traditional search world is that you need authority and brand power – then you’re relevant.

EGR: Did you expect the shift in AI search to happen as rapidly as it has?

JS: I would say yes and no. Had I anticipated the fast adoption and change? To some extent, because you know things go faster and faster. I was probably a bit surprised at the adoption of this, and I think it’s just the nature of being in tech and where the world is going.

EGR: Staying with AI, how is Playbook performing?

JS: We’ve historically focused on customer acquisition, and it is still a very big part of our business, but with Playbook, we are being relevant for anybody interested in sports betting.

I’ve been really pleased with the user traction and adoption we are seeing. From our partners’ perspective, we are allowing for a more convenient bet placement journey. When you are interested in placing single game parlays, multi-game parlays, which can be quite cumbersome if you have to do that manually, we’re creating convenience, and that is being very welcomed by our partners.

EGR: Where does the product go from here? Could users engage with Grok [X’s AI chatbot] to make a parlay to send to an operator?

JS: We focused on creating the best utility and infrastructure for people passionate about sports betting. We will continuously develop the product. We will do further integrations with the sportsbooks, and obviously, at some point in time, also make sure this will be live outside of the North American market. It is very much about creating convenience.

EGR: Finally, full-year 2025 guidance has been retained. The last 18 months have been a tricky spell for the business, but are you now feeling more confident?

JS: It has been a tough 18 months. We are now seeing organic revenue growth, and that’s very pleasing to see. We now have Q4 with full activity, all sports, and it is a great part of the year.

With the World Cup next year, our business being leaner and launching Playbook, I’m really pleased with where we are. There’s a lot of credit to my organisation; our people have really stepped up to deliver and adjust to all the change we’ve experienced. We are on a great path.

The post Q&A: Better Collective co-CEO on AI trends and a “tough” 18 months first appeared on EGR Intel.

.png) 2 hours ago

9

2 hours ago

9