- Polymarket poised to have lower trading costs than rival Kalshi

- It’s not clear if the fee schedule will be a permanent fixture

- Polymarket aiming to be live in the US by the end of November

Prediction markets operator Polymarket is readying a fee battle with rival Kalshi when it returns to the US, which it’s hoping to do later this month.

The Polymarket logo. The company will offer lower US fees trading fees than rival Kalshi. (Image: PR Newswire)

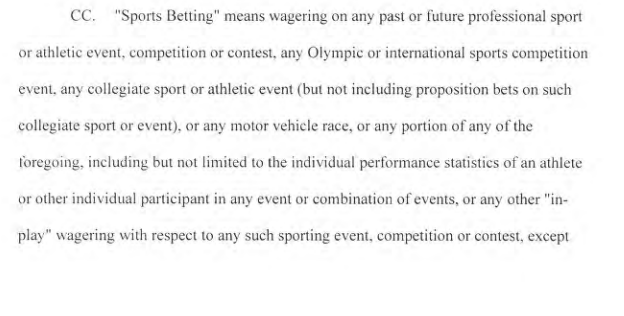

The Polymarket logo. The company will offer lower US fees trading fees than rival Kalshi. (Image: PR Newswire)The fee breakdown posted on www.polymarketexchange.com indicates the company will charge just a single basis point, or $0.01 on event contracts, confirming a flat-fee model will be implemented. Kalshi does things differently, structuring fees around contract odds, but it’s believed the average fee paid retail traders on that platform is 1.2% per contract.

It’s not clear if Polymarket’s lower-by-comparison trading costs are a temporary source of enticement to woo traders from its competitor in advance of its US return or if the company will keep those low costs in place for an extended period, but it is clear the derivatives exchange can alter transaction costs in the future.

The company may post an updated fee schedule on its website from time to time. Participants are deemed to have notice of any changes made to such fee schedule that are posted on the Company website,” according to the Polymarket Rulebook.

Last week, reports surfaced Polymarket is aiming to relaunch in the US by the end of this month in hopes of capturing a portion of football season wagering activity.

Polymarket Leveraging Vanguard Effect?

Following a regulatory squabble with Commodities Futures Trading Commission (CFTC), Polymarket was barred from operating in the US, opening the door for Kalshi to be prediction markets volume king in this country.

That doesn’t mean Polymarket can’t or won’t make inroads. Undercutting its competitor on costs as a smart idea and a different industry confirms as much. In the world of exchange traded funds (ETFs), it’s called the Vanguard Effect. Translation: Vanguard was late to the ETF business, but it’s now one of the world’s largest players in the space because it generally offers lower fees than competitors.

If Polymarket makes the 0.01% per contract charge a long-standing fixture, it could eat away at Kalshi’s US lead because over 100 trades, that works out to be about a penny on Polymarket, but $1.20 on Kalshi. For active retail traders, the savings would add up over the long-term.

Polymarket’s flat fee model could also be attractive to traders, particularly when measured against Kalshi’s sliding scale. For example, Kalshi charges 63 cents for 100 contracts priced at 10 cents apiece, but the platform’s fee jumps to $1.32 for 100 contracts priced at 25 cents,” according to its fee schedule.

Polymarket Has Multiple Revenue Outlets

Polymarket, which was recently valued at $9 billion to $10 billion after Intercontinental Exchange (NYSE: ICE) took a $2 billion stake in the firm, not surprisingly generates revenue from user fees, but it has other avenues for bolstering its top line.

Those include creation fees, meaning a charge to creators that launch new markets on the platform. Additionally, the company taps data monetization and liquidity provision as revenue streams.

The post In US Return, Polymarket Taking Fee Fight to Kalshi appeared first on Casino.org.

- Casino.org_ - www.casino.org.png) 7 hours ago

19

7 hours ago

19