- Company is reportedly working with investment bank Moelis.

- Creditors said to have hired a law firm known for Chapter 11 expertise.

- Affinity owns several Las Vegas-area and regional casinos.

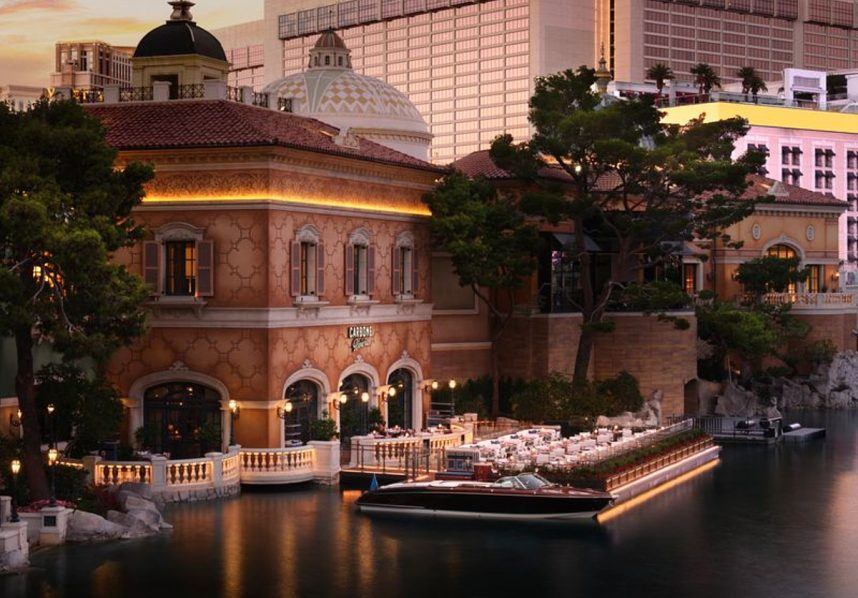

Affinity Interactive, the owner of the Silver Sevens Hotel & Casino in Las Vegas, is reportedly working with investment bank Moelis in hopes of potentially restructuring its outstanding liabilities.

Affinity Gaming’s Buffalo Bill’s Casino in Primm, Nevada. The company is rumored to be working with a bank to restructure its debt. (Image: Pinterest)

Affinity Gaming’s Buffalo Bill’s Casino in Primm, Nevada. The company is rumored to be working with a bank to restructure its debt. (Image: Pinterest)Earlier Friday, Bloomberg reported the operator of the Primm Valley Resort & Casino is working with Moelis to possibly compel bondholders to come the bargaining table for restructuring talks. Some of those creditors hired law firm Akin Gump Strauss Hauer & Feld LLP — known in part for its Chapter 11 bankruptcy expertise, according to the news outlet.

That same firm was recently hired by a consortium of Bally’s creditors that balked at that regional casino operator’s plans to sell the real estate of a Rhode Island casino to free up financing for its Chicago integrated resort.

Creditors of Affinity, which also owns the Daily Racing Form, are believed to be restless because the gaming company’s senior secured debt trades at significant discounts

Affinity Debt Ratios Surged

Affinity bondholders are right to be concerned. At the end of 2023, the company’s debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) was 7.8x, but that metric swelled to 11.7x by the end of the third quarter 2024. That compelled S&P Global Ratings to drop its grade on the gaming company to “CCC+” from “B-.”

Corporate bonds rated in “C” territory are considered highly speculative and vulnerable to default. S&P notes Affinity’s debt ratio trajectory isn’t tenable.

We view Affinity’s capital structure as unsustainable because we expect the company to sustain S&P Global Ratings-adjusted leverage above 8x through 2026, when it would likely begin to explore refinancing its senior notes. The downgrade reflects weaker than expected credit metrics and our forecast for leverage sustained above 8x,” according to the research firm.

In March 2023, Affinity sold the Rail City Casino in Sparks, Nevada to affiliates of Truckee Gaming, LLC to raise cash, but that transaction also modestly pinched EBITDA, said S&P Global.

Affinity Could Conduct Casino Fire Sale

Earlier this year, reports surfaced that Affinity is working with CBRE and Goldman Sachs to identify potential buyers for Silver Sevens and its three Midwest regional casinos — the Lakeside Hotel Casino in Iowa, the Mark Twain Casino, and St. Jo Frontier Casino in Missouri. Iowa and Missouri are competitive casino markets dominated by larger operators.

Deals for those properties haven’t been announced as of yet and it’s likely Silver Sevens is the most valuable, though it is an off-Strip property.

If Affinity sells those venues to raise cash, it’s casino portfolio would consist of Buffalo Bill’s in Primm, Nevada and Primm Valley Resort & Casino. The company also owns the Primm Center & Pilot Truck Stop.

The post Affinity, Owner of Las Vegas, Primm Casinos, Reportedly Seeking Debt Deal appeared first on Casino.org.

- Casino.org_ - www.casino.org.png) 5 hours ago

20

5 hours ago

20